The glory days where distributors offered full guarantee on all spoilage seems to be gone and in general we see a trend of more and more activities being pushed downstream and your convenience store purchasing data is becoming more and more important to your profitability. We see store owners struggling to cope with:

- The need of speed and granularity with reporting

- Coping with new areas of responsibility and how to analyze convenience store purchasing data

- Becoming less reliant on distributors and their reporting

- …and the C-store industry and competition is still growing!

Meanwhile, the environment is also changing and fuel efficient cars lower the frequency of opportunity, which only increases the opportunity cost caused by poor purchasing practices.

While analyzing the in-store data, what are your determining factors that identifies if a product should be rebought? At what quantities? Or should a product be terminated from your price book? How do you review your collected information with your distributors to negotiate better rebates or incentive programs? Is the speed of reporting appropriate or are your data reviews taking too long and causing stores to stock out on high margin products, ultimately costing you real dollars?

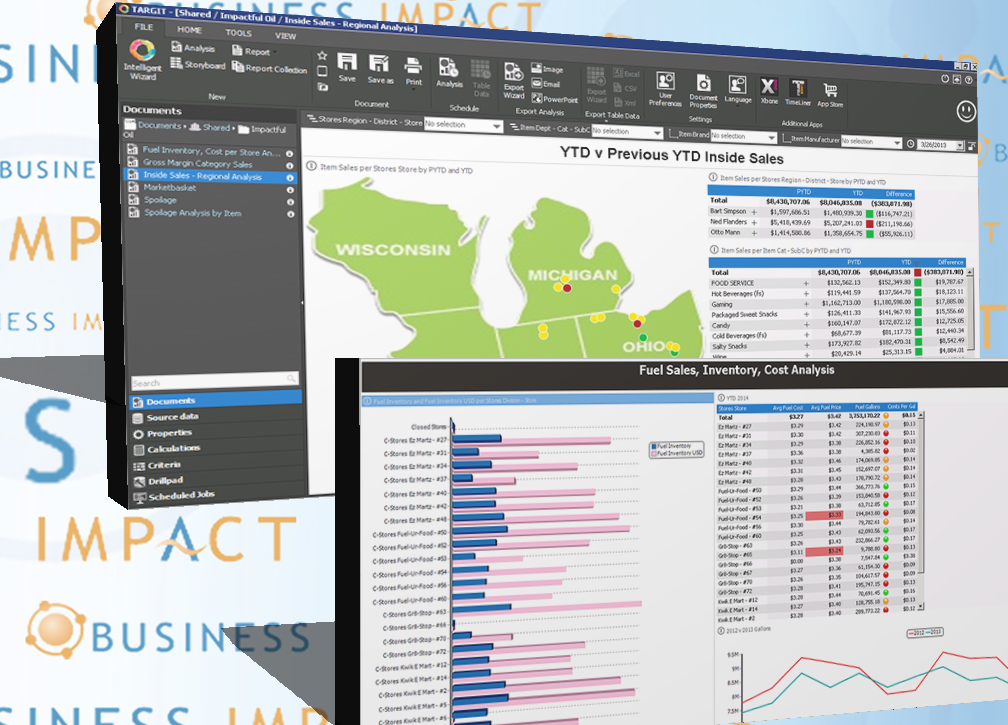

Here at Business Impact, we offer a solution that can take control of your convenience store purchasing data. Business Intelligence is a growing need for all and we are focused on your industry to deliver reports and analytics like you’ve never seen before. Our solutions offers flexibility and interactive interface that makes it simple to roll up daily data to week, month, quarter, then drill back down… or go from store totals, then drill down to category, sub-category, employee, etc… It’s all up to the user and being able to easily and quickly display the data they are needing to discover the information they are looking for.

Here’s how we can help:

- Reduce labor costs by automating processes and data

- Cut out data traffic jams by enabling all users, not just IT

- Making data actionable though indicators and alerts, and reducing clutter

- Aligning business performance with objectives

- Making better, faster decisions, making your C stores more profitable

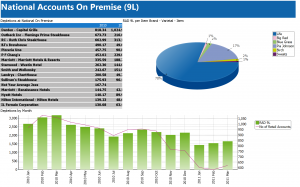

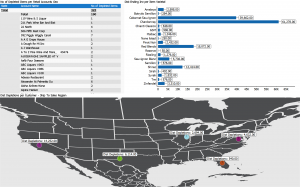

Understanding the c-store environment, we have successfully deployed solutions as well as offered additional requirements that may have once been overlooked. Don’t rely on your distributors’ data that may be inaccurate and possibly cost you missed rebates. Automated pattern recognition and alerts will help increase your ability to predict high margin products stock levels, quickly allowing your team to discover which items may be a loss leader, or a hidden gems that deserve better placement. Improve your ability to strike a healthy balance between profitability, inventory cost and sales flow by comparing across regions, districts and stores. Analyze Inside Sales per square foot by department or category or whatever else you desire. See average market basket of any transaction that has a Coke in it. Or any Coke product. Can you compare that with Pepsi? We can! You never have to go into a distributor meeting unarmed. Have your convenience store purchasing and sales data at your fingertips.

Automating the collection and organization of your data for usage is a large part in any successful BI solution. We pull the necessary data from the back office systems and other data sources. Data can come from your accounting package, spreadsheets, a labor system, or somewhere else. We focus on what adds most value, the ease of use, flexibility and performance is the design and management of this organization for delivery.

Check out our latest three minute video demonstrating convenience store’s Inside Sales Analysis. Or contact us to learn more!